Learning Go for a new job.

- 2 Posts

- 10 Comments

We now have a happy and healthy little baby. Mom and kiddo are doing great! We over the moon.

5·8 months ago

5·8 months agoI have some non-negotiables like sleep and my commute (~2hrs total). That means I have to compromise between time and activities at work or at home. During the winter months when days were short, I sacrificed fitness and stayed in a pattern of work, eat, sleep, repeat. Very little personal time. Days are lengthening and it’s getting warmer, so I plan to focus on my fitness and me again. Life also has seasons, I’m trying to embrace that.

1026·10 months ago

1026·10 months agoThe special was actually really good in my opinion. I personally like the idea of preserving cultural icons a la the talking heads in Futurama via AI. I do think the estate should get royalty rights like they would with deceased artists, but why not embrace this medium of immortality?

That seems really interesting, but not $30 app interesting.

2·1 year ago

2·1 year agoThink it’s just you. You should try viewing it not on mobile if it’s giving you issues. It’s a 1665x3441 pixel image, plenty of resolution to render all the text.

72·1 year ago

72·1 year agoGeneric “assume everyone on the Internet is from my country.” US Roth IRA contribution limits for 2023 is $6.5k, going up to $7k next year. If different country, disregard.

131·1 year ago

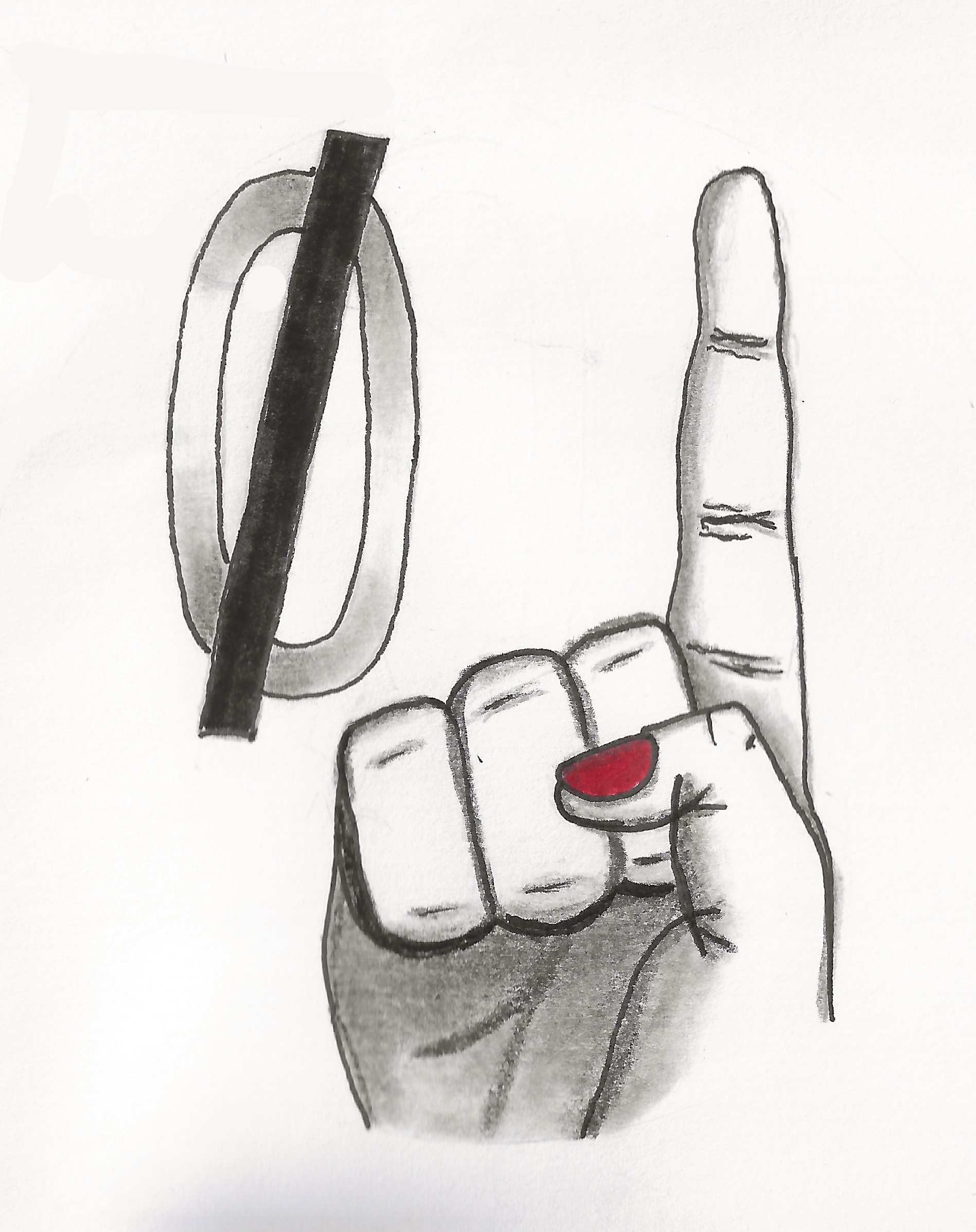

131·1 year agoThe Personal Finance wiki from that other site has a Prime Directive flowchart that spells out how you should allocate windfalls. Here’s the US flowchart but they have them for other countries with their respective finance programs.

In short, if you already are able to live off a smaller income, build an emergency fund so you don’t go backwards, then pay your future self. Don’t inflate your expenses unnecessarily because that just makes the goal of retirement cost more in the end.

7·1 year ago

7·1 year agoI’ve been utilizing “pay yourself first” for over a decade and it works for me. I preset my saving and investing goals which are set to auto deduct from my accounts, I have recurring bills on auto pay, then everything else remaining is fair game to spend guilt free. Could I invest more if I spent less on luxuries? Yes, but then I should have factored that in at step one then redone the exercise again for the following month with less obligated money remaining.

That being said, I do see the value in a formal budgeting solution since at the moment I only track my savings/investments and have a large blindspot to my expenses.

It’s a taquito.